INNOVATION IN PRIVATE CAPITAL FINANCING: BRIDGING AFRICA’S SPORTS INFRASTRUCTURE DEFICIT

Back to Categories

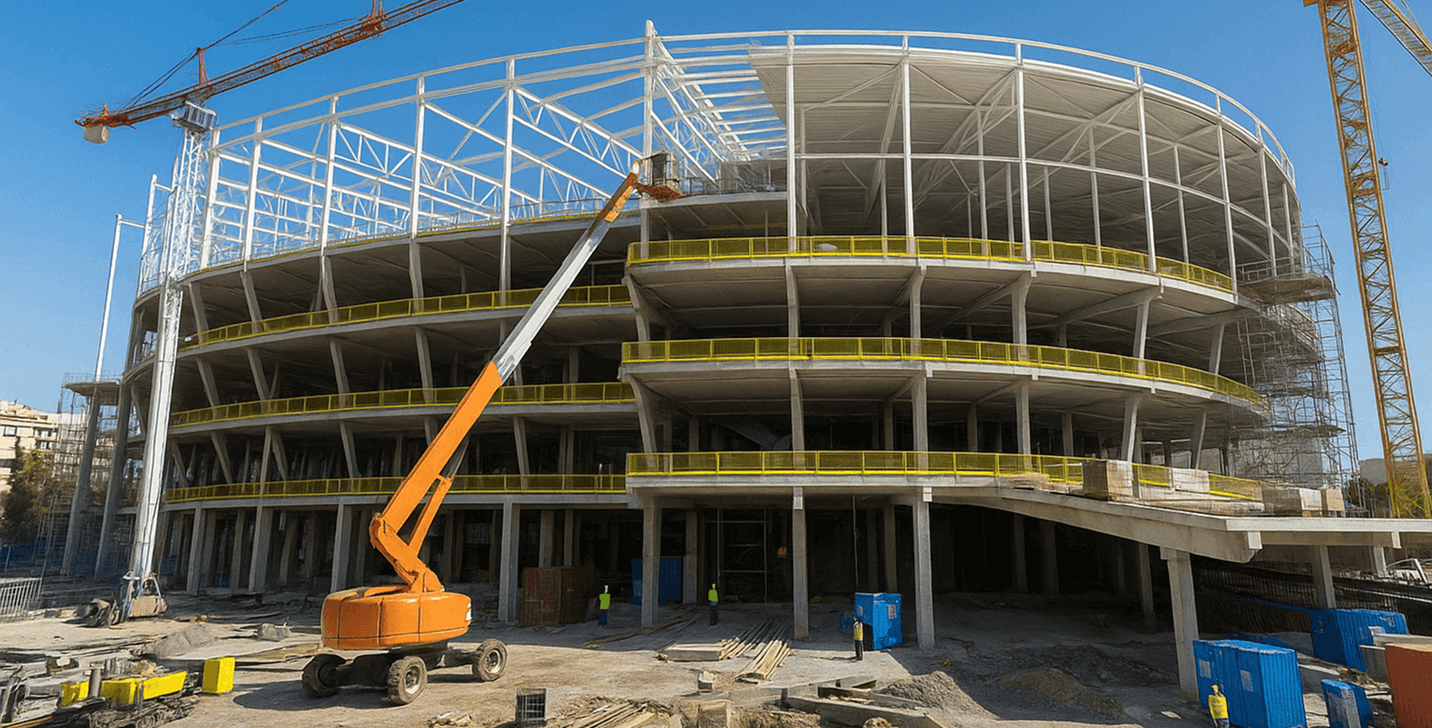

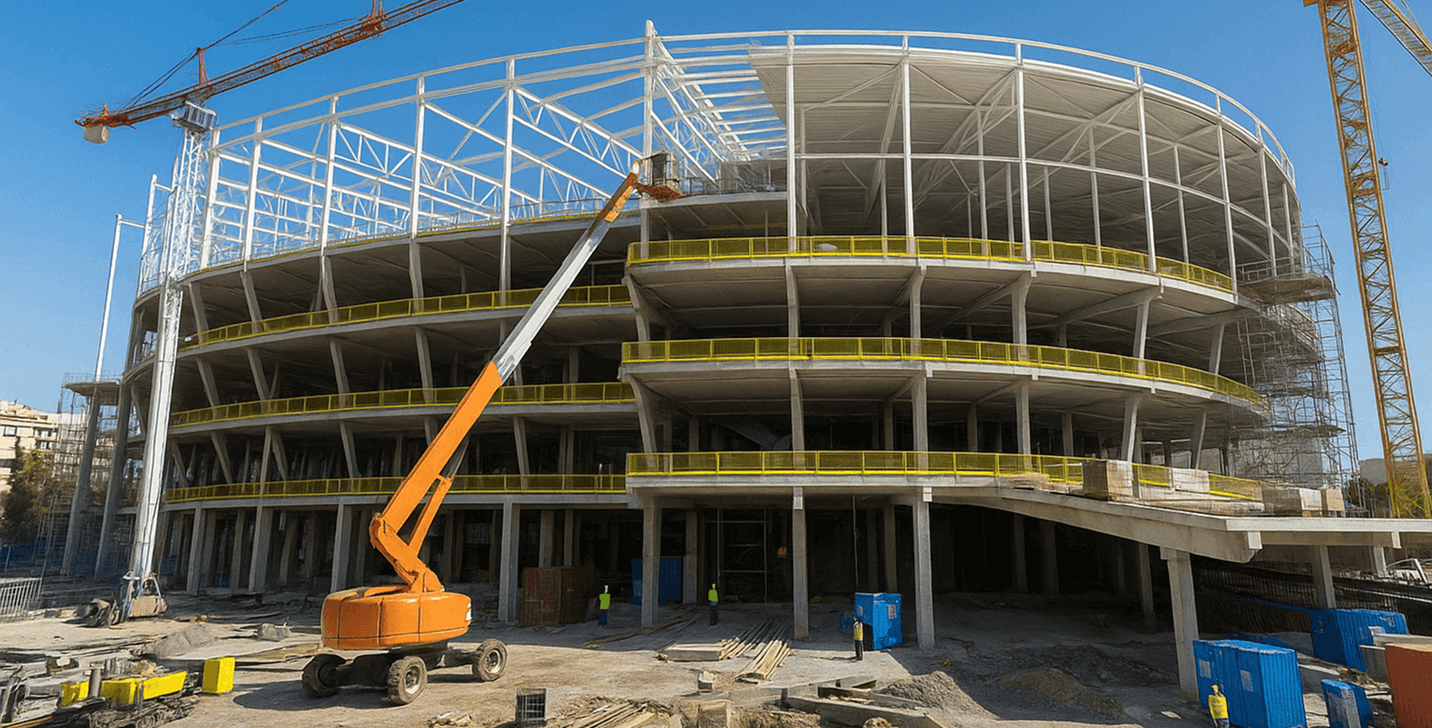

The growing recognition of sports as a powerful catalyst for socio-economic growth has sparked increased investment in state-of-the-art multipurpose sports facilities and the modernization of existing venues.

These complexes stand not only as symbols of national pride but also as vibrant arenas where passion for the game comes alive, and future sports stars are nurtured. They hold tremendous potential to transform a country or region into a premier sports tourism destination by hosting mega global mass-audience events.

Today, modern facilities have become essential strategic investments for unlocking the commercial viability of the entire sports industry value chain. They open new avenues for optimizing revenue generation across diverse commercial touchpoints, including naming rights, sponsorship, ticketing, broadcasting, merchandising, retail, and hospitality, while also enhancing the overall fan experiences.

Yet in Africa, much like in many other developing economies, these opportunities remain largely untapped. Sports infrastructure is often inadequate, underdeveloped, and poorly maintained due to underfunding. Governments typically prioritize essential sectors like healthcare and education amid tight budget constraints.

This challenge presents a unique opportunity for greater private sector involvement in addressing the widening gap in sports infrastructure. Innovative financing instruments, such as Infrastructure Asset-Backed Securities (IABS) and public-private partnerships, are being explored to mobilize private and global capital, rather than placing the financial burden on taxpayers through public debt.

Discussion topics

- State of sports infrastructure across Africa: challenges and opportunities

- Innovative & sustainable financing models for developing sports infrastructure in Africa

- Private Equity: reshaping the future of sports investment and growth opportunities across Africa

- Case studies of successful private financing for sports infrastructure in Africa

- Policy frameworks and strategies to enhance investor confidence in African sports infrastructure

- Impact of improved sports infrastructure on local economies and youth empowerment

- Trends in design, construction, operation, and maintenance of multi-purpose sports facilities, and strategies for maximizing usage and impact